Section 106 exemption

Contents |

[edit] Introduction

On 23 March 2014, the government launched a consultation to consider scrapping Section 106 charges for self-builders, homeowners, developers wanting to bring redundant buildings back into use and builders on small sites (10 units or 1,000 sqm gross floor area). It was claimed that these charges can make such developments economically unviable. Ref gov.uk Charges adding thousands of pounds to building costs to be axed 23 March 2014.

On 28 November 2014, Eric Pickles MP, Secretary of State for Communities and Local Government (CLG) announced plans to cut the cost of building a new home for small builders by up to £140,000. This was intended to boost recovery in the housing sector following the 2008 crash. In 1990 small and medium sized builders built more than 60% of new homes, in 2014 they accounted for just a third.

The proposals made clear that Section 106 agreements should generally not be sought from the smallest housebuilders on sites of 10 homes or fewer, including self-build homes, extensions and annexes. In very rural areas, sites of 5 homes or fewer should not face the charge.

Section 106 agreements, sometimes known as planning obligations or planning gain are obligations intended to mitigate or compensate for the negative impacts of developments or to prescribe the nature of developments. They are intended to make acceptable developments which would otherwise be unacceptable. Examples include; requiring that the development provides affordable housing, requiring compensation for the loss of open space, or making a contribution to the provision of additional infrastructure to serve the development.

Section 106 agreements must be:

- Directly relevant to planning.

- Necessary to make the proposed development acceptable.

- Directly related to the proposed development.

- Reasonable and in proportion to the development.

However, the Department for Communities and Local Government suggested that some councils were charging up to £145,000, (Purbeck district council in Dorset charges up to £140,000 on a new 5-bedroom dwelling) in some cases more than the cost of building the home. On single properties in England they believed the policy would save £15,000 per home on average.

These proposals came in addition to an existing exemption from the Community Infrastructure Levy for homes that are owner-occupied and built or commissioned by individuals, families or groups of individuals for their own use.

Pickles said, ‘Small builders are being hammered by charges, which have undermined the building industry, cut jobs and forced up the cost of housing. By getting rid of these 5 and 6-figure charges, we will build more homes and help provide more low-cost and market housing.’

The Home Builders Federation said, ‘The time and expense of negotiating Section 106 affordable housing contributions on small sites, and the subsequent payments, can threaten the viability of small developments and act as another barrier to the entry and growth of smaller firms.’

Pickles also announced plans for a £25 million fund to boost development finance and unlock construction on sites of between 5 and 15 homes. This is part of the Builders Finance Fund scheme and takes the form of loans, which the developer repays on completion and sale of the homes.

NB In 2010 measures within the Community Infrastructure Levy Regulations came into force clarifying the relationship between planning obligations and the community infrastructure levy and restricting the use of planning obligations. The community infrastructure levy (CIL) is a charge that local authorities can choose to impose on new developments to fund infrastructure. The introduction of the community infrastructure levy should result in a scaling back in the imposition of planning obligations.

The Community Infrastructure Levy Regulations state that Section 106 agreements cannot be used to double charge developers for infrastructure. Once an authority has introduced the levy in its local area, it must not use section 106 agreements to fund infrastructure they intend to fund via the levy. See Community Infrastructure Levy for more information.

[edit] High Court ruling

In a landmark case at the High Court in July 2015, Justice Holgate quashed government policy on affordable housing exemption thresholds, as a result of the which, planning guidance on planning obligations was amended to remove paragraphs 012-023. In addition, the vacant building credit policy was quashed.

West Berkshire Council and Reading Borough Council challenged these policies arguing that the consultation process had been unlawful. Justice Holgate accepted that the government had failed to take into account "obviously material" considerations.

A spokesman for the Department for Communities and Local Government spokesman said that they would be seeking permission to appeal against the judge’s decision.

See R (on the application of West Berkshire District Council and Reading Borough Council) v Secretary of State for Communities and Local Government for more information.

[edit] Related articles on Designing Buildings Wiki

- Community infrastructure levy.

- Planning condition.

- Planning permission.

- R (on the application of West Berkshire District Council and Reading Borough Council) v Secretary of State for Communities and Local Government.

- Section 106 agreement.

- Self-build home.

- Vacant building credit.

[edit] External references

- DCLG, Pickles cuts stealth taxes on new homes and boosts small builders, 28 November 2014.

Featured articles and news

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

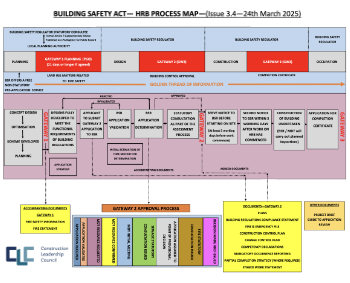

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

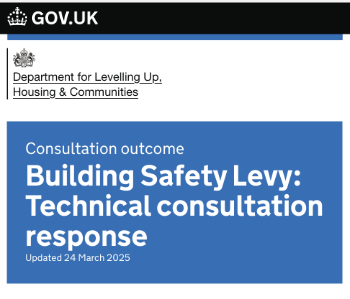

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.